Rental Trends For 2025

Zillow’s annual report on renter preferences and the market in general offers a sneak peek into the coming year

The Post-Pandemic New Normal

Nationally, rent rates have cooled, and even trended negative in certain markets. Nearly a third of rentals are offering some type of rent concession, which has been the trend since fall 2023.

More than just Memphis is experiencing a construction boom – nationwide, as of June, more multi-family units were on track to be completed by the end of 2024 than anytime in the past 50 years.

With the pandemic and inflation impacts fading, budgeting is still a top priority for most renters. Many renters still aim to buy a home, and 58% of recent renters considered buying before choosing to rent. But affordability remains a major challenge, requiring extra savings.

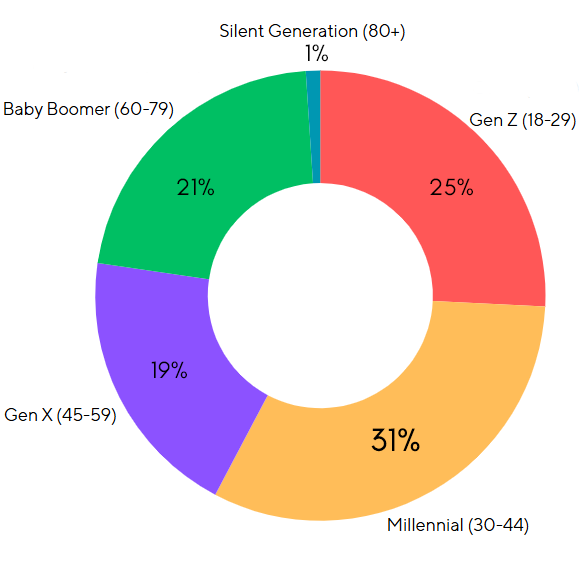

The share of renters considering buying a home dropped from 64% in 2023. According to Zillow’s analysis of U.S. Census data, the average renter’s age steadily increased from 36 in 2000 to 40 in 2023, then jumped to 42 in 2024, showing how homeownership affordability remains tough.

All of this makes the market more competitive for rental professionals. Whether you’re already feeling the pressure or think it’s on the way, understanding your audience can help you communicate better, keep occupancy rates up, set the right prices, and reduce turnover.

Key Findings for 2025

Budget is the top priority for renters

Just as in 2023, 95% of renters reported that staying within their initial budget is essential—more important than any other rental feature Zillow surveyed. In 2022, the U.S. Census Bureau showed that the average household income in Downtown Memphis is about $74,000. This would mean that an average household has about $2000 to pay per month on housing.

Delaying homeownership may continue with renters

Although fewer renters considered buying a home in 2024, the coming year is expected to bring some relief to affordability challenges for prospective buyers.

Renters who wish to buy in the future may especially appreciate amenities like rent payments being reported to credit bureaus or flexible lease terms.

“Amenities that actually save renters money can reduce turnover with hopeful home-savers. This can also attract younger renters who aren’t yet considering a home purchase but instead may consider moving back in with family to save money.”

— Zillow Senior Economist Orphe Divounguy

Renters strongly prefer transparent fees

94% of renters believe listings should clearly disclose all fees, while 90% think they should have the option to decline fees for unused services. Additionally, 77% feel rental fees should be included in the total rent rather than charged separately.

901 Real Estate Services has always worked to actively disclose all fees associated with renting, including them in our listings, as well as making sure our leasing agents are fully informed. Our Resident Benefit Package, which includes reporting rent payments to credit bureaus, is added to the total rent.

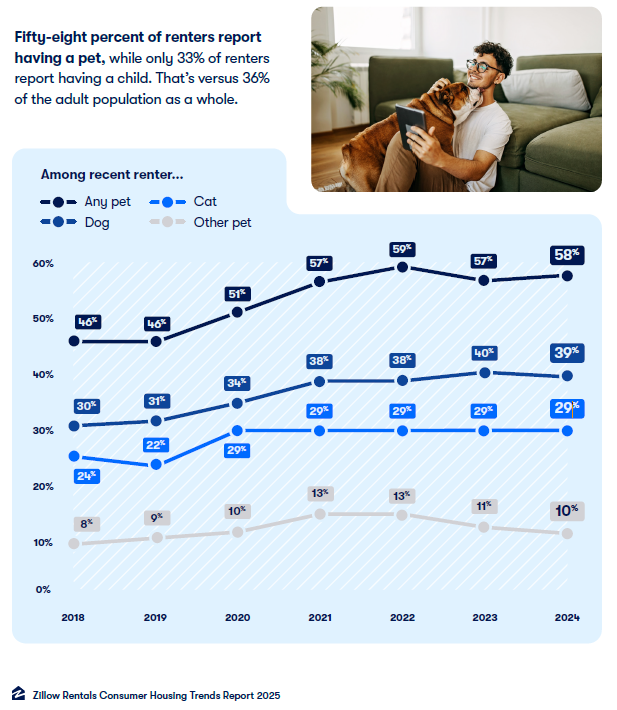

Listings that restrict pets are being passed over

Six out of ten renters say that a property allowing pets is essential to deciding whether they rent or not. 44% of renters say they passed on properties that prohibited pets. 32% said they passed on those that had restrictions on breed, size, and type of pets. While 33% of renters have children, 58% have at least one pet.

In Conclusion

We’ll be continuing to delve into market conditions, renter trends, and more in the coming months. We typically see more movement in the rental market with the new year and at the end of school semesters. If you’d like to discuss more about your property and the upcoming year, reach out to us any time.