Memphis Rental Market Updates

While many cities in the US have continued to see a strong rental market, other cities (like Memphis) are cooling down.

Increased Supply Causing Drops in Rents

According to Berkadia’s Q1 2024 Multi-Family report, the Downtown/Midtown Memphis submarket alone has 4,723 units under lease-up, construction, or planned. This oversaturation of available rentals has not only increased Memphis’s general vacancy rate, it has caused rent prices to drop.

Southern Cities Most Affected

Many cities in both the Southeast and Southwest have been impacted by this increased supply. According to Evernest, these are the top markets where rents fell by at least 5% in July 2023:

- Fort Worth, TX: -10.2%

- Memphis, TN: -8.6%

- Houston, TX: -7%

- Charlotte, NC: -6.9%

- Atlanta, GA: -6.3%

- Nashville, TN: -5.5%

- Dallas, TX: -5.5%

- Austin, TX: -5.1%

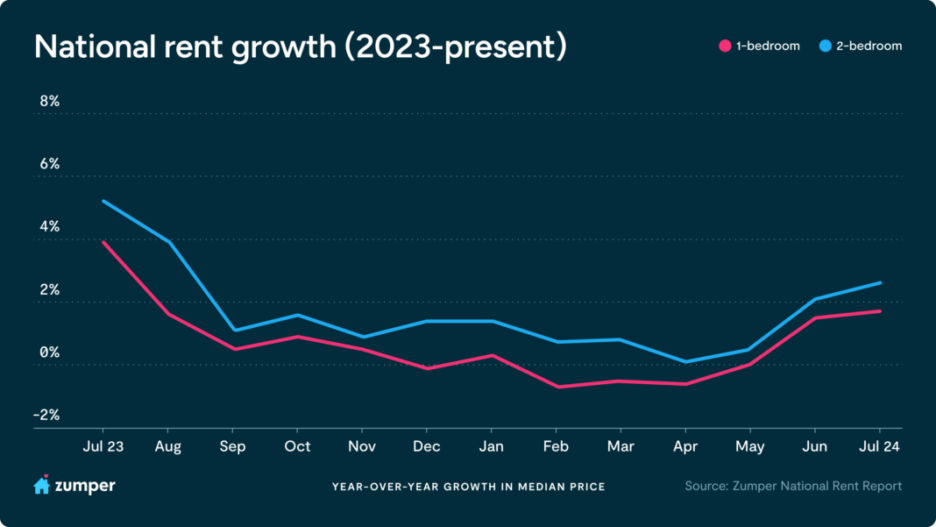

The good news is that we are beginning to see some rebound. However, Memphis is still #91 out of 99 markets tracked by Zumper for average rent prices. The current average rent for a one bedroom in Memphis is $960.

Key Takeaways

New housing options give prospective tenants more choices. Residents are feeling confident in their ability to find properties, and many landlords are offering concessions for new renters. This could be a month free, a monthly decrease in rent, or even covering utilities.

“We believe the #1 takeaway is that you need to be aware of your local market when pricing your rental. If you price it too high, you’ll likely lose a great resident. The competition is getting more aggressive.” — Evernest

What’s New at 901RES – Updates in Income Verification

Leveraging the latest software to verify both income and employment

Even the most seasoned property managers can be deceived by sophisticated fake check stubs, IDs, and other documents. In the past, verifying employment could be difficult, especially with self-employed applicants. At 901 Real Estate Services, we have even seen applicants list completely made up companies on their applications.

However, with a little homework, common sense, and technology, distinguishing fraudulent information from the real deal keeps getting easier. 901RES uses software that asks applicants to log into their employer’s payroll system or their bank account. This software checks for actual deposits and real income. Even just letting prospective tenants know about this process can stop dishonest applicants in their tracks.

We are constantly perfecting and updating our rigorous screening processes for applicants. Besides income verification and credit check, we also do extensive research on prospective tenants. 901RES is dedicated to protecting our owners, their assets, and our company. We know that taking more time and research on the front end stops many headaches in the long run.